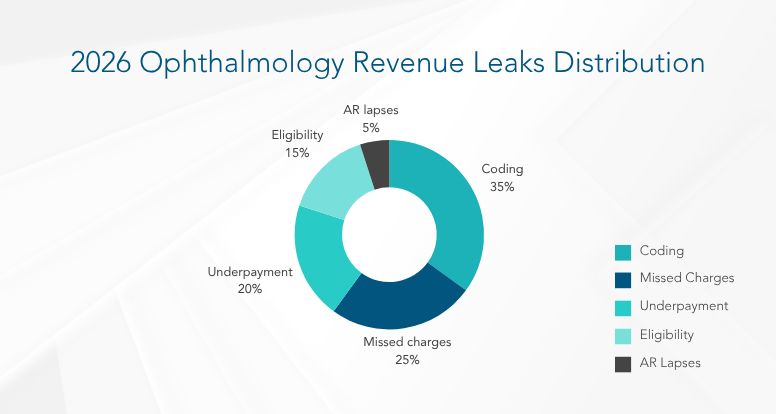

Ophthalmology remains one of the most profitable specialties in outpatient care, generating over $62 billion globally (IBISWorld, 2024), with U.S. practices averaging $3–5 million per provider annually. Yet, even large multi-location groups earning $50 million or more lose 3–10% of revenue each year to silent profit leaks, often with no visible warning signs.

In 2026, practices face mounting pressure from rising costs, payer complexities, and inefficiencies. Even top performers lose 2–5% annually to underpayments, missed charges, or workflow gaps (PMC, 2023), which is a $1–2M hit for a $50M practice.

As payer rules evolve, manual oversight falls short even with a strong EHR, disciplined teams, and streamlined workflows. Leading RCM teams now rely on AI-driven analytics platforms, automation, and consulting to regain visibility and control.

This 2026 RCM Playbook equips RCM Directors, CFOs, and Practice Administrators with a roadmap to detect, quantify, and eliminate revenue leaks, turning RCM into a strategic growth engine.

The 2026 Ophthalmology RCM presents a perfect storm. Reimbursement rates are tightening, claim denials and payment delays are rising, administrative costs are climbing, and advanced clinical technologies demand greater investment.

Meanwhile, manual or outdated revenue cycle processes struggle to keep pace, leading to inevitable gaps where revenue simply slips away.

“Revenue loss in ophthalmology isn’t about denial volume, it’s about the silent underpayment patterns that compound over time.” – Karen Harrell, CPA, RCM Consultant at HFMA (2025)

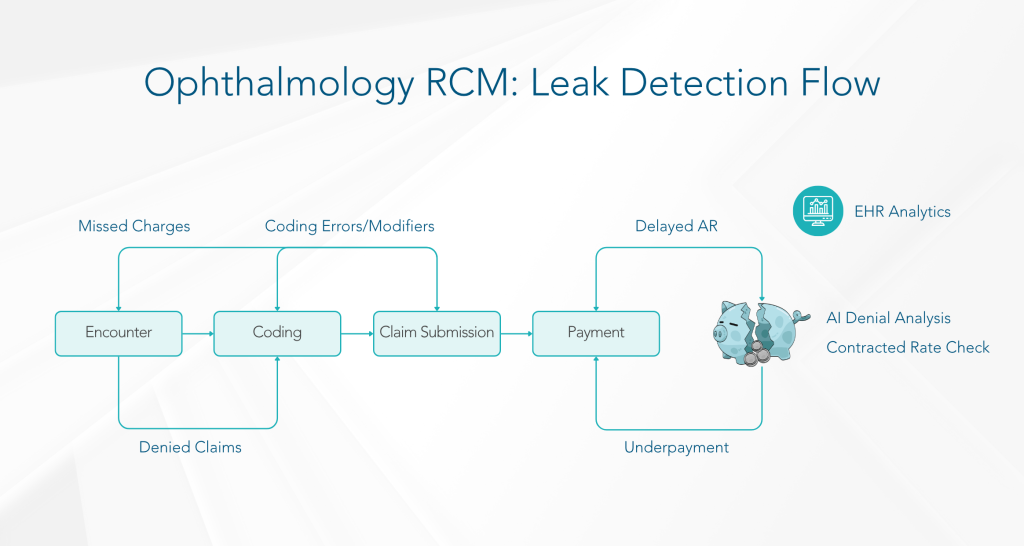

Detecting revenue leaks in 2026 demands more than spreadsheets and manual reviews. It requires a sophisticated toolkit powered by advanced technology and strategic methodologies. Here’s a four-step detection framework that most high-performing groups follow:

AR Aging Heatmap: Create a visualization by payer and CPT family, identify who contributes to the 120+ day bucket.

Embed systematic leak-detection practices across all seven RCM domains to close gaps in charge capture, coding, authorizations, and collections transforming each pain point into opportunities for proactive, data-driven remediation.

1. EHR Optimization and Data Flow

A seamlessly integrated EHR is the first line of defense against missed charges and coding errors. Practices with optimized EHR systems experience up to 25% fewer billing errors and reduce encounter-to-billing lags by 30%.

Ensure all encounter components (comprehensive exam, imaging, in-office procedures, diagnostics like OCT, visual fields, IOLMaster) flow automatically into billing queues.

Leverage AI-driven analytics to flag encounters with missing charge lines practices that audit daily see 95% charge-capture accuracy versus 80% when audited monthly.

Audit/Validation Questions:

Are scheduling, documentation, and billing modules fully bi-directional?

Do anomaly-detection alerts fire when billed services deviate from typical procedure bundles?

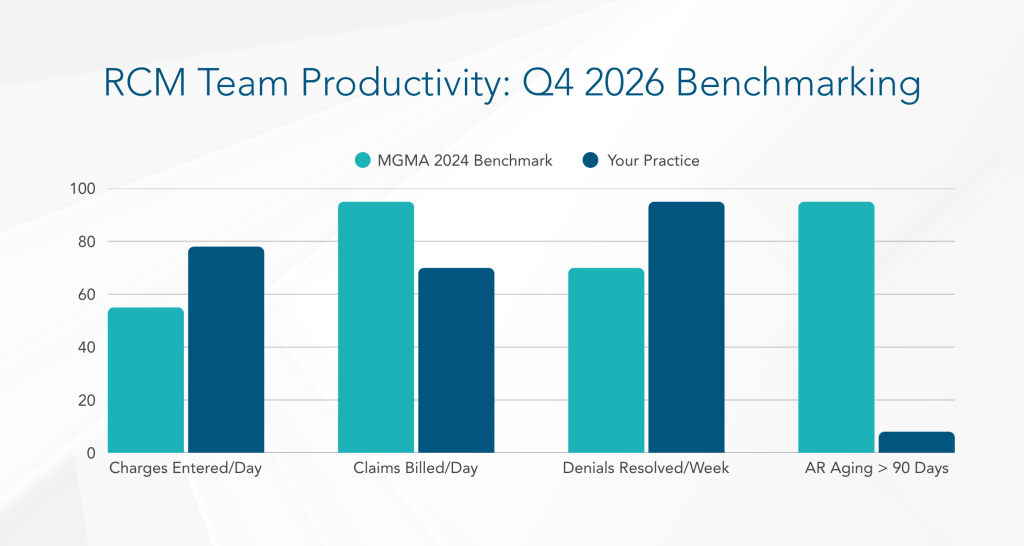

2. Team Productivity and Resource Efficiency

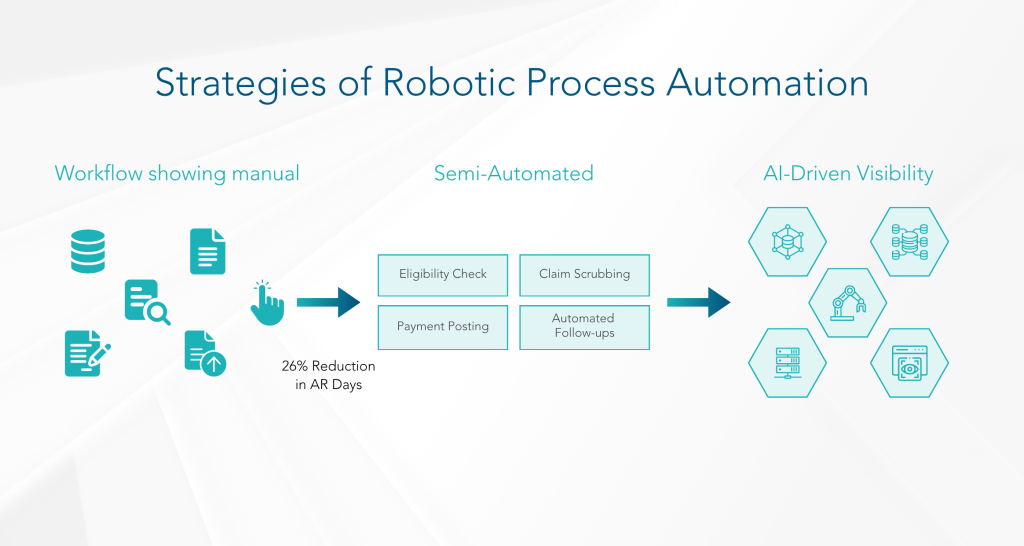

Human capital variance in RCM can exceed 30% in productivity. Automating repetitive tasks preserves high-value staff time.

Deploy RPA bots for charge capture, modifier verification (-25, -59, -RT/-LT), and claims-status checks. Practices using RPA reduce coding-related denials by 40%.

Monitor staff performance against benchmarks: average claims entered/day of 85, denial closures/week of 50, and payment postings/day of 60.

Audit/Validation Questions:

Are staff meeting claims/day and denial-closure targets?

Do cross-training protocols maintain throughput when key personnel are absent?

3. Industry Benchmarking

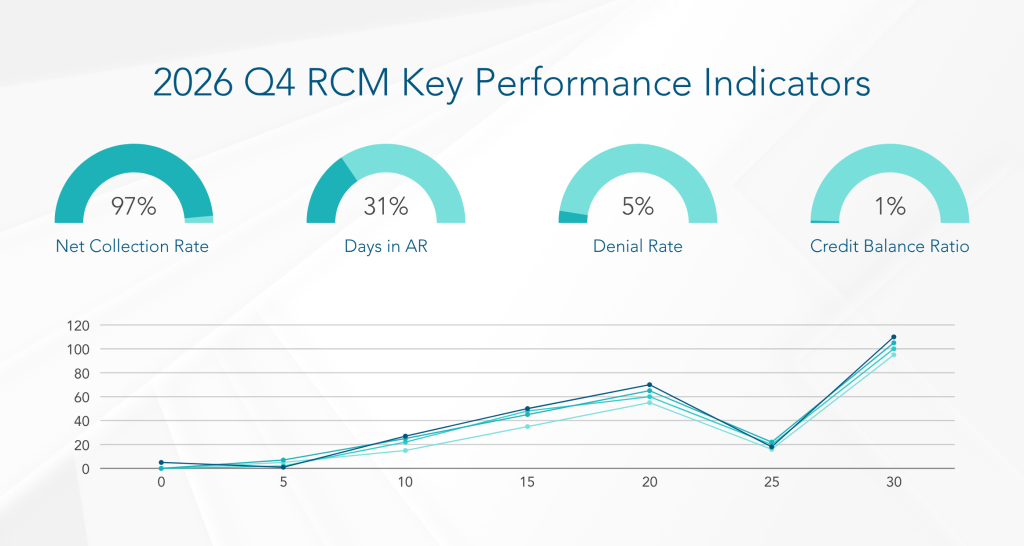

Benchmarking reveals hidden underperformance. Top-quartile ophthalmology practices achieve net collection rates ≥95%, clean-claims rates ≥98%, and average Days in Receivables Outstanding (DRO) of 40–45 days.

Compare net collection rate, denial rate, A/R days, and payer adherence against MGMA, AAOE, and historical data.

Target denial rates <10%; practices above this threshold investigate root causes immediately.

Audit/Validation Questions:

How does net collection rate, denial rate, and A/R >90-day volumes compare to top-quartile benchmarks?

Are recurring deviations in modifier-related denials investigated and corrected?

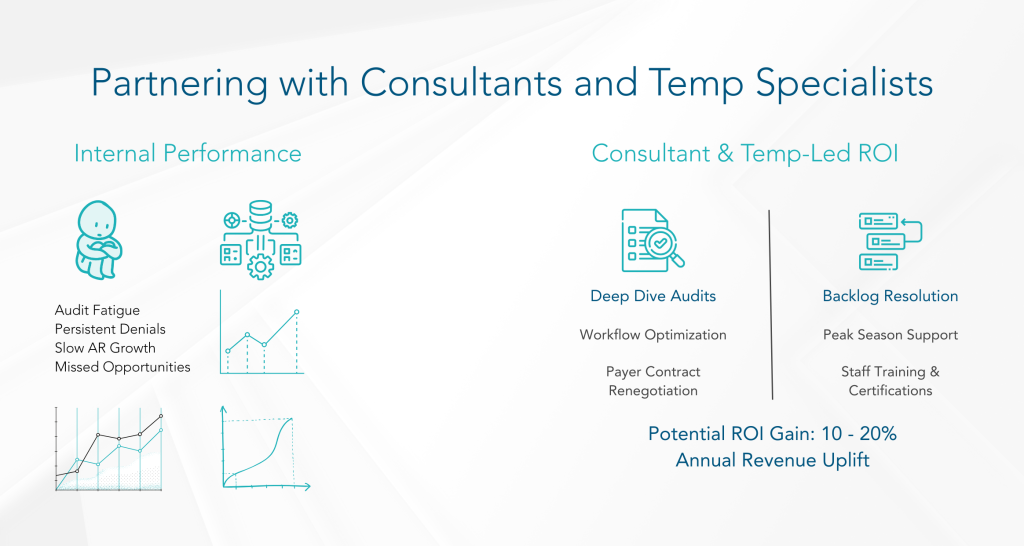

4. Proven Outsourcing

Outsourcing denial management can improve key metrics: denial overturn rates exceed 65% with specialized vendors versus 45% in-house, and AR turnaround times shrink from 75 to 45 days.

Engage vendors with sophisticated software that categorizes denials by payer, reason, and provider for root-cause analysis.

Enforce SLA KPIs: denial overturn %, AR turnaround, and payment accuracy.

Audit/Validation Questions:

Are vendor denial overturn rates and AR turnaround outperforming in-house benchmarks?

Is outsourcing driving down cost-to-collect (3–5% target) versus internal operations?

5. Revenue Integrity and Leak Detection

Underpayments account for 1–3% of net revenue annually, with some ophthalmology groups losing up to 12%. Systematic audits and predictive analytics recover 70% of underpaid funds.

Implement predictive models to forecast underpayments; trigger appeals for reimbursements below contract rates.

Audit 100% of encounters to billed claims, emphasizing post-operative visits where minor supplies are often missed practices gain 2–4% incremental revenue through focused post-op charge capture.

Audit/Validation Questions:

Are all encounters reconciled to billed claims daily?

What percentage of write-offs are reviewed manually versus auto-waived?

6. AI and Automation

AI pre-scrub tools reduce first-pass denial rates from 15% to 5% by correcting missing modifiers and outdated codes before submission.

Use AI to predict denials (e.g., missing -25 modifiers, outdated CPT/ICD-10 codes) and auto-correct claims.

Automate routine AR follow-ups, eligibility checks, and pre-auth renewals practices automating >80% of pre-auth workflows see denials drop by 20%.

Audit/Validation Questions:

Are denial-prediction models and claim pre-scrubs in active use?

What percentage of eligibility and pre-authorization tasks are fully automated?

7. Front, Middle, Back-End RCM Cohesion

Most revenue leaks occur at departmental handoffs. Cohesive workflows reduce pre-auth errors to <1% and ensure charge entry/coding within 48 hours.

Integrate front-desk eligibility verification, middle-office coding, and back-office payment posting on a unified platform.

Embed automated claim scrubbing at coding-submission handoff to catch modifiers and code issues.

Audit/Validation Questions:

Front-End: Is pre-auth error rate <1%?

Middle-End: Are charge entry and coding turnaround times <48 hrs?

Back-End: Are payments posted and reconciled within SLAs?

By systematically applying these seven domains and leveraging industry benchmarks 95%+ net collection rates, 40–45 DRO, <10% denial rates, and recovery of 70% of underpayments, ophthalmology practices can transform each pain point into measurable RCM improvement.

6. AI and Automation

AI pre-scrub tools reduce first-pass denial rates from 15% to 5% by correcting missing modifiers and outdated codes before submission.

Use AI to predict denials (e.g., missing -25 modifiers, outdated CPT/ICD-10 codes) and auto-correct claims.

Automate routine AR follow-ups, eligibility checks, and pre-auth renewals practices automating >80% of pre-auth workflows see denials drop by 20%.

Audit/Validation Questions:

Are denial-prediction models and claim pre-scrubs in active use?

What percentage of eligibility and pre-authorization tasks are fully automated?

7. Front, Middle, Back-End RCM Cohesion

Most revenue leaks occur at departmental handoffs. Cohesive workflows reduce pre-auth errors to <1% and ensure charge entry/coding within 48 hours.

Integrate front-desk eligibility verification, middle-office coding, and back-office payment posting on a unified platform.

Embed automated claim scrubbing at coding-submission handoff to catch modifiers and code issues.

Audit/Validation Questions:

Front-End: Is pre-auth error rate <1%?

Middle-End: Are charge entry and coding turnaround times <48 hrs?

Back-End: Are payments posted and reconciled within SLAs?

By systematically applying these seven domains and leveraging industry benchmarks 95%+ net collection rates, 40–45 DRO, <10% denial rates, and recovery of 70% of underpayments, ophthalmology practices can transform each pain point into measurable RCM improvement.

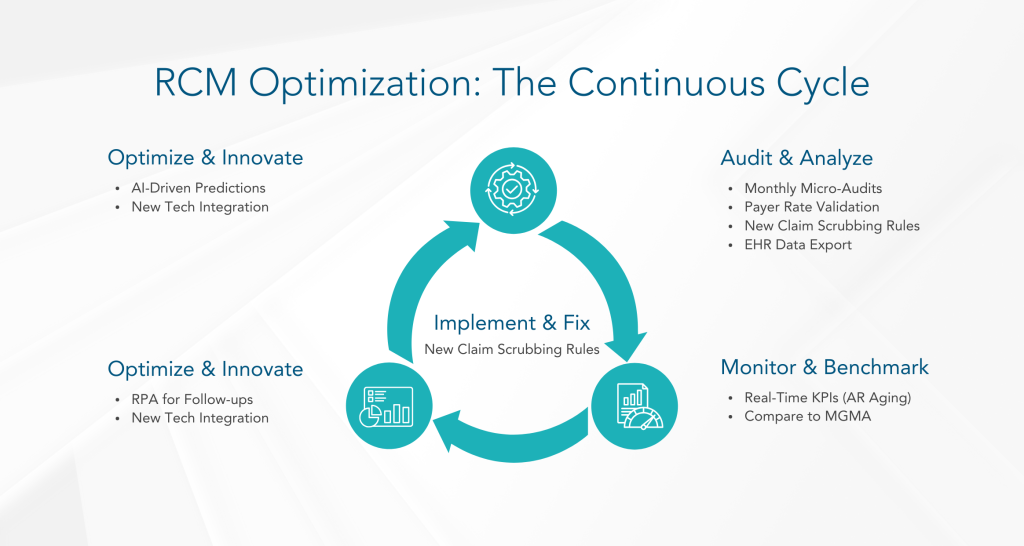

Establishing a repeatable audit process ensures that revenue leaks are not only identified but also measured and prioritized for remediation. Once you’ve identified potential leak points, the next critical step is to quantify the actual revenue loss. This data-driven audit framework provides a repeatable process to measure impact and prioritize solutions.

Embedding this Data-Driven Audit Framework into the Modern RCM Director’s Toolkit ensures that each leak-detection domain is not only monitored but also quantified empowering ophthalmology practices to prioritize high-impact interventions and sustainably optimize revenue cycle performance.

For every 1% improvement in net collection rate, large ophthalmology practices can recover 100K-250K annually. Understanding this direct financial impact is crucial for gaining buy-in for RCM investments.

Sustainable leak elimination requires targeted operational adjustments and continuous KPI-driven oversight—focusing on team productivity, streamlined workflows, and a narrowed set of high-impact metrics.

Labor drives nearly half of RCM costs in ophthalmology (45–60%). Even strong teams underperform without regular benchmarking and corrective action.

| Metric | Benchmark (MGMA 2024) | Ideal Range |

|---|---|---|

| Charges entered/day | 65–80 | >70 |

| Claims billed/day | 55–75 | >65 |

| Denials resolved/week | 75–100 | >90 |

Automate real-time scorecards to highlight under-performers and initiate targeted coaching when individuals fall below thresholds.

Leverage RPA for Routine Tasks:

Offload repetitive processes—charge capture imports, modifier validations, payment postings—to bots. Freed capacity allows skilled staff to tackle complex denials and appeals, boosting denial-resolution throughput by 40%.

Cross-Training and Peak Coverage:

Develop a formal cross-training program ensuring every team member can handle charge entry, coding checks, or appeals workflows. Rotate assignments weekly to prevent skill silos and maintain consistent productivity during absences.

2. Focus on Five High-Impact KPIs

Concentrating on a concise KPI set drives 90% of revenue outcomes, streamlining management focus and eliminating metric overload.

| KPI | Target | Why It Matters |

|---|---|---|

| Days in A/R | <35 days | Reduces cash-flow delays and write-offs |

| Net Collection Rate | >96% | Maximizes actual revenue realization |

| Charge Lag | <2 days | Minimizes denial risk from timeliness |

| Denial Rate | <6% | Reflects coding/pre-auth accuracy |

| Credit Balance Ratio | <2% | Indicates proper payment application |

By integrating these strategic fixes—centered on productivity optimization, KPI discipline, and process-embedded controls—ophthalmology practices can not only detect but permanently seal revenue leaks, achieving sustained improvements in cash flow, reimbursement accuracy, and overall RCM efficiency.

RCM success isn’t a one-time project, it’s a loop of audit, fix, and feedback.

Recommended Cycle:

“Revenue integrity is no longer a back-office function, it’s a strategic growth driver.” – Dr. Susan Miller, CFO, American Academy of Ophthalmology (2025)

The landscape of healthcare finance is only growing more complex. In 2026 and beyond, sustainable growth for large ophthalmology groups will depend not just on clinical excellence, but on proactive RCM intelligence. The era of reactive billing is over.

By adopting a healthcare analytics platform, leveraging automation, and committing to continuous improvement, RCM Directors can transform their practices from merely surviving to truly thriving. Don’t let hidden revenue leaks drain your potential. Take control, optimize your RCM, and secure the financial future of your ophthalmology group.

2424 North Federal Highway, Suite 205

Boca Raton, FL 33431