by Carrie Bauman

Revenue benchmarking provides a clear picture of how your practice matches up to industry standards. By comparing your ophthalmology practice revenue with similar-sized practices, you can identify gaps in your financial performance and pinpoint areas where improvement is needed. For example, many practices find they are underperforming in areas like reimbursement for IOL surgeries or facing higher-than-average claim denials. Benchmarking against your peers allows you to take corrective action, improving your practice’s financial health.

WhiteSpace Health’s platform is specifically built to provide revenue benchmarking for ophthalmology practices. Its RCM (Revenue Cycle Management) dashboard tracks key metrics and compares your data with national benchmarks. This helps you identify trends, set realistic goals, and take actionable steps to improve performance.

For example, WhiteSpace Health’s platform can track the number of denied claims, by payer, provider, location and more, clarifying specifically where your claim denial rate is above the industry average. Drill down capabilities in the platform clarify the specific procedures that are being denied, informing upstream billing process changes to avoid future denials. Machine Learning (ML) in the platform finds patterns of successful claims resolution and packages it so your RCM teams can always select the option with the highest probability of success, ensuring you get paid more of what you earned – quicker.

This KPI measures the total number of billing transactions processed over a specific period. It provides insight into the workload and efficiency of your billing staff. A higher volume could signal a need for more resources or highlight opportunities for optimization.

Monitoring the number of bills sent to insurance payers and other funding sources daily is essential for managing cash flow. It ensures that your practice maintains a steady inflow of payments, which directly impacts liquidity.

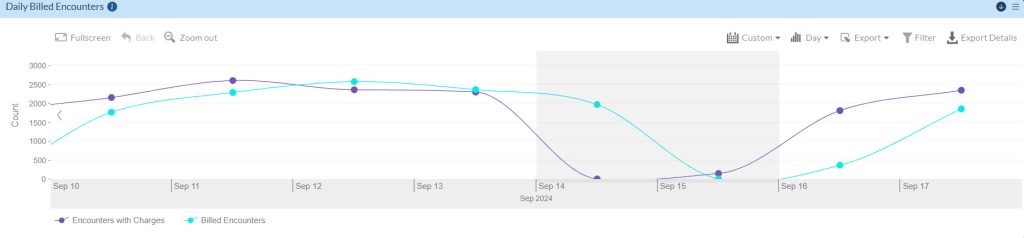

This KPI tracks the number of patient encounters, and the corresponding financial charges generated on a specific service date. Keeping an eye on this can help ensure that no patient services go unbilled, improving revenue capture.

The Relative Value Units (RVUs) measure the total service value based on the complexity and time involved. This is a critical metric for assessing the workload and productivity of healthcare providers within your practice.

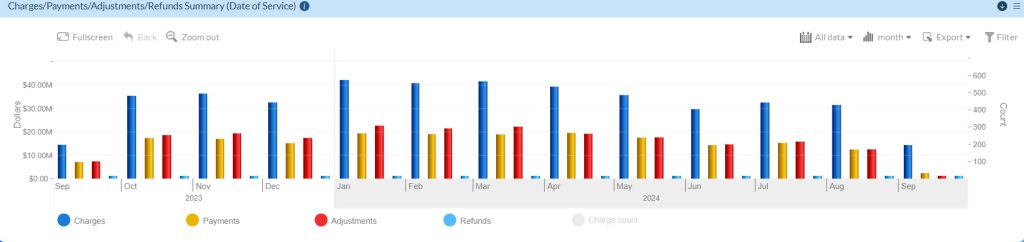

This summary aggregates key financial transactions within your practice, offering a comprehensive overview of your practice’s financial health. With this summary, you can spot trends and areas where adjustments are necessary.

Accounts Receivable (A/R) Days measures the average number of days from when services are provided to when payment is collected. This is a critical measure of liquidity, and reducing A/R days can significantly improve cash flow.

This KPI categorizes your accounts receivable based on the duration invoices have been outstanding. It helps identify potential collection issues, allowing you to act before those balances become uncollectible.

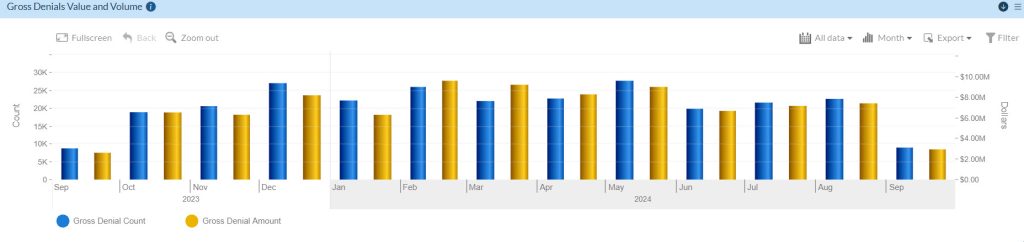

Measuring the total initial value and number of claim denials before any appeals are processed gives you insights into the effectiveness of your initial billing process. High denial rates signal areas where documentation or coding may need improvement.

This KPI compares total net payments received to the total gross charges billed. By doing this, your practice can assess how effective your collection process is, helping to highlight where improvements are needed.

This metric measures the total value of payments received from payers. It is essential to assess how efficiently payments are being processed by payers and if there are any delays.

This KPI tracks the total amount written off due to non-payment or adjustments. A high write-off rate can reflect inefficiencies in your billing processes or issues with payer contracts, which may need renegotiation.

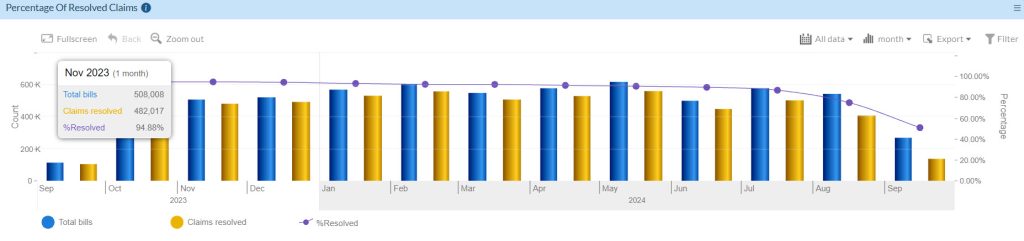

This metric measures the proportion of claims resolved after their initial submission. It includes claims that require adjustments or appeals, offering a clear picture of the effectiveness of your revenue cycle management processes.

By tracking these metrics using WhiteSpace Health’s financial dashboards, you can make data-driven decisions that improve ophthalmology practice performance. Each of these KPIs plays a crucial role in providing a full picture of your revenue cycle, enabling better resource allocation, and improving overall efficiency.

Several challenges can impact the financial performance of an ophthalmology practice. Here’s how revenue benchmarking and key performance indicators can help address these issues:

One of the biggest points of pain in ophthalmology is declining reimbursements, especially for high-cost surgeries and procedures. By benchmarking your reimbursement rates against the industry, you can see if you’re being underpaid and take steps to renegotiate contracts with payers.

Denied claims are a significant source of lost revenue for many ophthalmology practices. With ophthalmology KPIs like denial rates and denial write-offs, you can identify which procedures face the highest denial rates and implement strategies to prevent these denials in the future.

Post-COVID, many practices are struggling with staffing shortages and turnover. Monitoring staff productivity KPIs, such as encounters per full-time equivalent (FTE), can help you optimize staffing levels to ensure you’re not overstaffed or understaffed, which can directly impact patient satisfaction and revenue.

Once you’ve identified areas for improvement through benchmarking, it’s essential to implement actionable changes. Start by setting specific goals based on your ophthalmology KPIs. For example, if your Days in A/R is higher than the industry standard, aim to reduce it by 10% over the next six months.

Other actionable steps include:

Provide your staff with training on how to handle claims more efficiently to reduce errors that lead to denials.

Improving communication with patients about their financial responsibilities can help reduce bad debt and increase collections.

Ensure your billing team is following best practices for coding and claims submission to avoid unnecessary delays or denials.

By leveraging revenue benchmarking, your ophthalmology practice can gain insights into its financial health and overall performance. Tools like WhiteSpace Health’s RCM dashboard empower you to track essential performance metrics and make data-driven decisions. Whether you are looking to reduce claim denials, optimize Days in A/R, or increase revenue per procedure, benchmarking your performance against industry standards is the first step toward sustained financial success.

Incorporating real-time financial dashboards into your practice’s workflow will allow you to stay ahead of challenges and ensure your team makes informed decisions that drive profitability. It is time to take control of your practice’s future by leveraging the power of ophthalmology practice revenue benchmarking and improving your ophthalmology practice performance with data.

A 30-year veteran in healthcare IT, Carrie Bauman is responsible for marketing, communications and business development strategies that drive brand awareness, growth and value for clients, partners, and investors.

2424 North Federal Highway, Suite 205

Boca Raton, FL 33431