by Ivan Bradshaw

Denied claims are one of the largest sources of frustration for CFOs and revenue cyclemanagers (RCM) in all sorts of healthcare organizations. Denials impede the ability RCM professionals to create a predictable and well-optimized stream of cashflow that is essential for the health of the business. At an individual claim level, many accounts possess both patient responsibility and payer components. Payer denials can affectwhether the patient receives a correct and timely bill for their services – which impacts the provider’s collections. Denials may have the potential for customer service implicationsthat can cloud perceptions of clinical excellence.

Reasons for Lack of Coverage Denials

This type of denial results from the patient’s failure to maintain insurance coverage or to keep the specifics of coverage updated with their provider. The main reasons for a lack of coverage denial are:

Lack of insurance denials is preventable. To avoid a lack of coverage denials, staff need to focus on four things:

Timely intervention and follow-up are essential to secure reimbursement for denied claims, the appeals processes, and proactive identification of trends or patterns to ensure targeted interventions occur before timely filing deadlines pass. Identifying the root causes of eligibility denials and implementing corrective actions are also needed at the source of their occurrence to prevent their happening again.

The introduction of AI can greatly reduce and minimize lack of coverage denials. Here are two ways that AI can significantly lower lack of coverage denials.

Harnessing the power of integrated systems, the Automated real-time verification process swiftly retrieves and verifies the patient’s insurance particulars, precisely verifying the active status of policies, and effective coverage dates. Beyond mere eligibility verification, the function provides comprehensive insurance benefits and coverage analysis. It meticulously calculates co-payments, assesses deductibles, and flags any stipulations or exemptions pertinent to the requested medical services.

Predictive Analytics

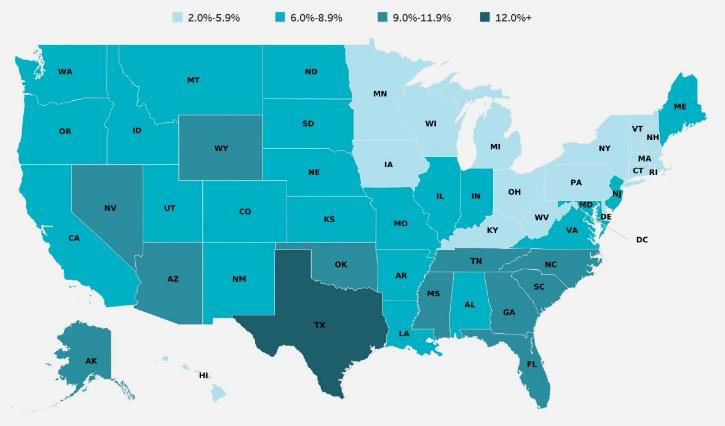

Using AI and ML (machine learning) based predictive models identify the trends associated with eligibility coverage information. These technologies scour historical patient demographics and payment patterns in different combinations and variables and identify the trends associated with

eligibility coverage information.

Medical Claim Analysis

By Using AI and ML algorithms, the WhiteSpace Health™ Platform analyzes medical records and claims data to ensure the treatment that was rendered aligns with the payer policy terms. This analysis helps identify accounts where coverage might be denied due to treatments not covered under the policy.

The WhiteSpace Health Approach

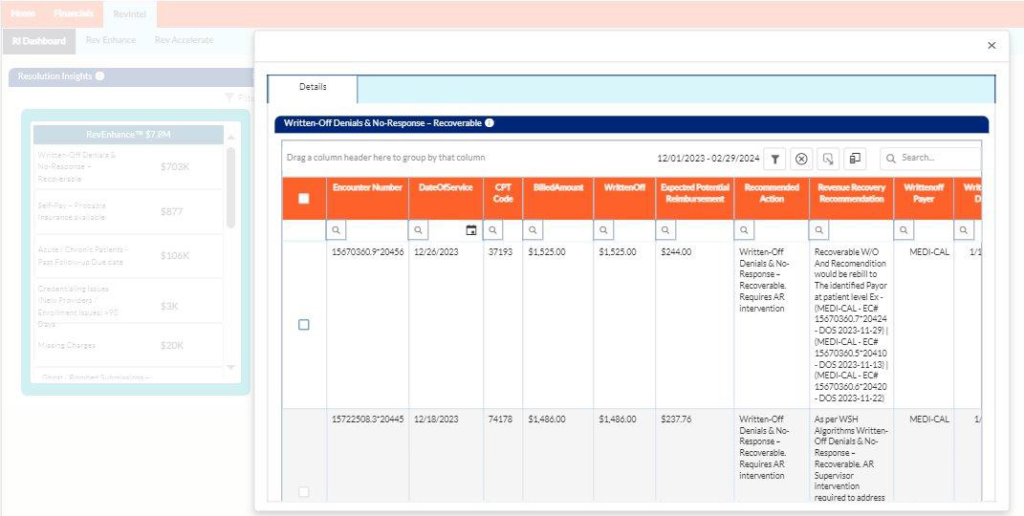

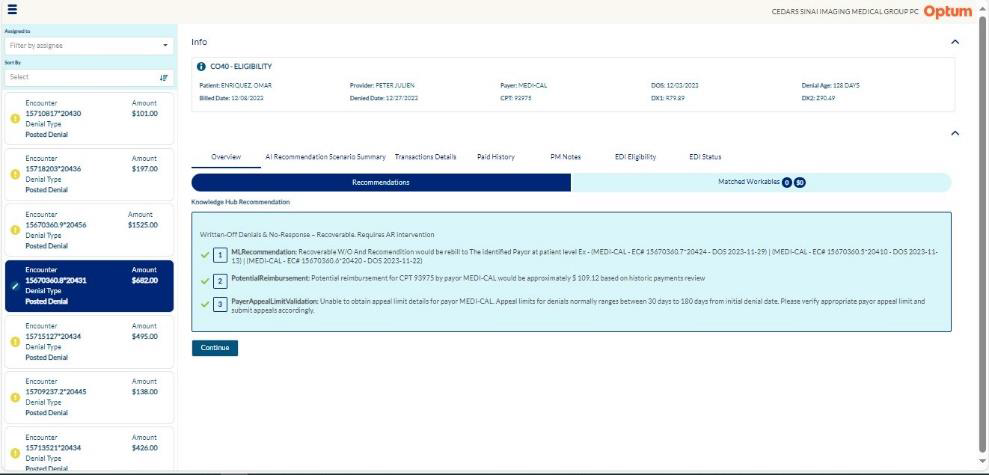

WhiteSpace Health’s RevEnhance™ solution interprets historical data and aids with the best

path to resolution-based recommendations, so users and staff can act on the claims that were denied by the payer filter and act accordingly towards resolution.

AI in the platform identifies all the lack of coverage denials that can still be recovered.

ML presents evidence-based steps so staff can

select the actions with the highest

Monitor data validation results and compare expected to actual collections.

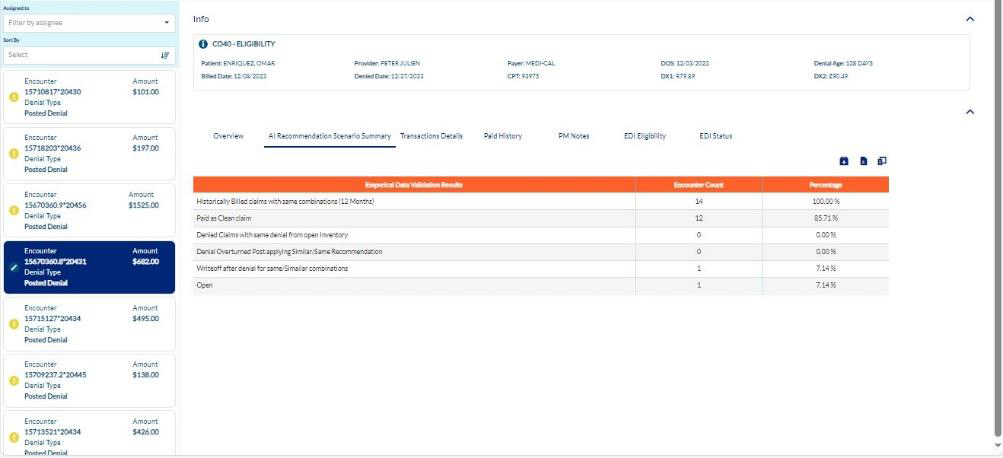

By applying AI and ML to the lack of coverage claims, your team is immediately presented with a list of accounts that are still recoverable, eliminating the need to download reports from the EMR/PMS system, load them into a spreadsheet, sort, calculate which claims have yet to hit the timely filing deadline, prioritize by dollar value or other criteria – all before working the accounts can commence. When staff are in short supply, moving repetitive manual tasks to software is a smart business decision.

Culling through claims and other information, grouping, analyzing, and presenting data is a key strength of AI. Humans do not have this capability. Additionally, people often introduce errors, particularly as complexities of the calculation and analysis increases. AI ensures the highest quality data so you can take the right actions – quickly.

ML uses hard evidence and seeks out patterns where your organization was successfully reimbursed in the past to make its guided recommendations on how to best act. By removing “tribal knowledge” and training inconsistencies between employees, AI allows your team to act based on the evidence that has historically shown to get you paid.

About Ivan Bradshaw

Ivan Bradshaw is the vice president of product management at WhiteSpace Health. As a revenue cycle management executive with over 20 years of experience, Ivan is adept at building high-performance teams and creating RCM solutions that stop revenue leakage, improve

operational efficiency, and grow top-line performance.

2424 North Federal Highway, Suite 205

Boca Raton, FL 33431