by Carrie Bauman

As a healthcare provider, managing your healthcare revenue cycle has never been more challenging. With insurance claim delays and claim denials on the rise, your organization’s financial health is at risk. This growing trend is creating substantial roadblocks in your ability to receive timely payments, directly impacting your cash flow and operational stability.

Efficient denial management is now essential to keep your revenue cycle moving smoothly. This blog will delve into how the increasing number of claim denials and payment delays from payers are devastating healthcare claims processes, and how advanced tools like WhiteSpace Health’s platform can help identify, resolve, and monitor these issues effectively.

Healthcare providers have seen a steady increase in claim denials and delays. According to a recent survey, over 40% of providers reported losing more than half a million dollars annually due to claim denials, with 18% reporting losses exceeding one million dollars. These staggering numbers underscore the importance of having a robust denial management process in place.

Denials not only delay reimbursements but also increase administrative overhead. The cost of appealing a denied claim can range between $25 to $50 per claim, according to the American Medical Association. Given the sheer volume of claims processed by healthcare organizations, the financial burden is significant.

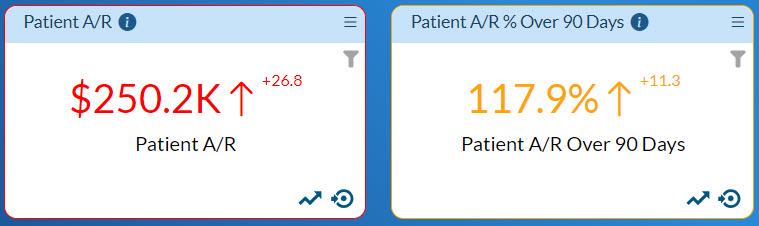

Moreover, insurance claim delays create additional complications. They disrupt cash flow, strain resources, and affect patient satisfaction. As delays stretch beyond 90 days, your organization is left scrambling to cover costs and maintain its operations.

Denial management, the process of identifying, reviewing, resolving, and preventing denied claims, has always been crucial in maintaining a healthy revenue cycle. However, with payers’ increasing claim denials, the complexity of managing these denials has expanded, making it more difficult for providers like you to stay on top of their claims reimbursement processes.

Many providers are outsourcing their denial management to revenue cycle management (RCM) companies to improve efficiency, reduce overhead, and ensure timely payments. However, without a proper denial prevention strategy, even the best outsourcing partner cannot fully protect your revenue stream.

Denial management is no longer just about identifying errors; it’s about gaining insights into why claims are denied, how to address root causes, and what steps to take to prevent future denials.

Moreover, the American Hospital Association (AHA) reports that denials from Medicare Advantage payers rose by 55.7%, while commercial payers saw a 20.2% increase in denials during the same period. These denials contribute to significant volatility in accounts receivable, creating operational challenges for providers.

The impact of insurance claim delays doesn’t stop at your cash flow—it affects your patients, too. When payers’ claim denials drag on, healthcare organizations are delayed in billing their patients, which can lead to frustration and even reduced patient payments. The longer the wait, the less likely patients are to pay their bills, further complicating your healthcare revenue cycle management.

The financial toll of claim denials goes beyond just lost revenue. For every denied claim, your organization incurs additional administrative costs, resources are diverted from patient care, and the overall efficiency of your operation suffers.

With such high costs and delays, it is crucial for your organization to identify denial trends early and take proactive measures to reduce their frequency and financial impact.

WhiteSpace Health offers an AI-powered platform that gives you complete visibility into your denied claims. The system flags claims that need immediate attention and provides detailed insights into why claims are denied. By identifying the root causes of denials, your team can address these issues and reduce the frequency of future denials.

WhiteSpace Health offers an AI-powered platform that gives you complete visibility into your denied claims. The system flags claims that need immediate attention and provides detailed insights into why claims are denied. By identifying the root causes of denials, your team can address these issues and reduce the frequency of future denials.

One of the platform’s standout features is its KPI Smart Cards. KPI Smart Cards create transparency to the health of various revenue cycle and operational workstreams. Using a stoplight metaphor, they guide your eye to areas that need to be immediate attention in red. The dimensions that influence performance are organized by tabs. Your team can prioritize denials based on their financial impact, helping you recover cash faster. Whether coding errors or insufficient documentation or other issues are problematic, the platform helps you resolve them efficiently.

WhiteSpace Health’s platform groups similar types of denials together, allowing your staff to process a bolus of the same type of claims in a batch, increasing efficiency. Claims can also be filtered by dollar amount, ensuring ensures that the highest-value denials are processed first. Transparency delivered by the platform also enables you to monitor the entire denial management process, from initial identification to successful resolution.

By leveraging the WhiteSpace Health platform, your organization can experience the following benefits:

To protect your revenue stream, you need a strategic approach to denial prevention and management. Here are some best practices to consider.

Focus on resolving the denials that have the most significant financial impact first.

Ensure that your team is well-trained in documentation and coding practices to reduce errors.

Leverage data analytics tools like WhiteSpace Health to identify trends and patterns in your denied claims.

Regularly compare your performance to industry standards to stay competitive and identify areas for improvement.

The rise in insurance claim delays and claim denials is creating significant challenges for healthcare providers like you. However, with the right tools and strategies in place, you can take control of your revenue cycle and minimize the impact of these disruptions. WhiteSpace Health’s denial management feature offers a comprehensive solution to help you identify, resolve, and monitor denials more effectively, ensuring that you get paid what you’re owed and keep your revenue cycle moving forward.

By implementing best practices and utilizing advanced technologies, you can overcome the challenges posed by payers’ claim denials and delays, ultimately safeguarding your organization’s financial health.

A 30-year veteran in healthcare IT, Carrie Bauman is responsible for marketing, communications and business development strategies that drive brand awareness, growth and value for clients, partners, and investors.

2424 North Federal Highway, Suite 205

Boca Raton, FL 33431