by Carrie Bauman

Maintaining financial predictability is vital for sustainability in any healthcare organization. Hospitals, medical groups and clinics, face numerous challenges that can lead to revenue loss if not carefully managed. This is where payment KPIs (key performance indicators) come into play, providing a structured way to monitor the financial health of the organization. By using a KPI dashboard and a KPI framework, you can track these indicators, allowing you to optimize revenue cycle and avoid unnecessary debt rate and revenue leakage.

Precise financial management can make or break an organization. Measuring payment KPIs is crucial because:

If your organization doesn’t track payment KPIs, you may not realize how much revenue leakage is happening. For example, minor coding errors or uncollected debts can lead to significant revenue loss over time. According to a recent survey, about 25% of healthcare organizations experience consistent revenue leakage due to inefficient billing practices.

By focusing on collection rate as a payment KPI, you can determine how well your organization is collecting payments from insurance companies and patients. A low collection rate may indicate issues in the billing process or that your staff needs additional training to follow up on payments more effectively.

Unpaid bills lead to a higher debt rate, which can negatively impact cash flow. Monitoring your debt rate through your KPI dashboard will help you identify trends and develop strategies to reduce the amount of unpaid debts over time.

By consistently measuring payment KPIs, you can minimize revenue loss. When you know where money is leaking, you can take corrective action, be it through better coding practices, more efficient collections, or streamlined billing processes.

A structured KPI framework improves not just financial outcomes, but also operational efficiency. When payment-related KPIs are tracked regularly, your healthcare organization can streamline administrative functions, reduce claim denials, and better allocate resources.

One of the most effective ways to measure payment KPIs is by using advanced analytics platforms such as WhiteSpace Health’s AI analytics platform. This platform integrates a powerful KPI dashboard that allows you to measure a wide range of payment KPIs, providing a clear picture of your organization’s financial health.

Monitor how much of your total billing remains unpaid over time.

See how much of the billed amount has been successfully collected.

Identify inefficiencies that lead to lost revenue, such as incorrect billing or missed payment follow-ups.

Stay ahead of financial declines by identifying potential losses early. By using WhiteSpace Health’s AI-driven analytics, you can transform your organization’s financial management strategy and optimize your billing and payment processes.

WhiteSpace Health’s KPI dashboard is packed with powerful tools to monitor and manage your healthcare organization’s financial performance. Below is a breakdown of some critical payment KPIs available on the platform:

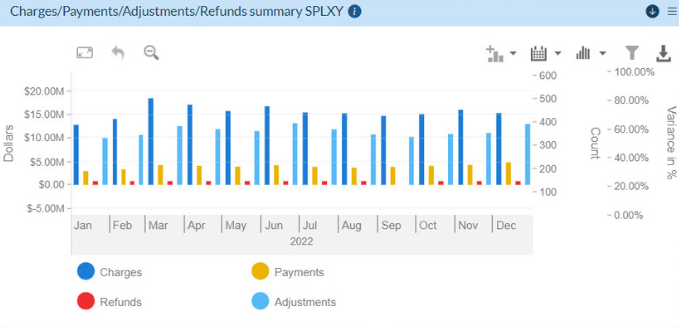

This payment KPI provides a comprehensive overview of your organization’s financial activities, including total charges, payments received, adjustments made, and refunds issued. By tracking this data, you can quickly identify trends in revenue loss or revenue leakage.

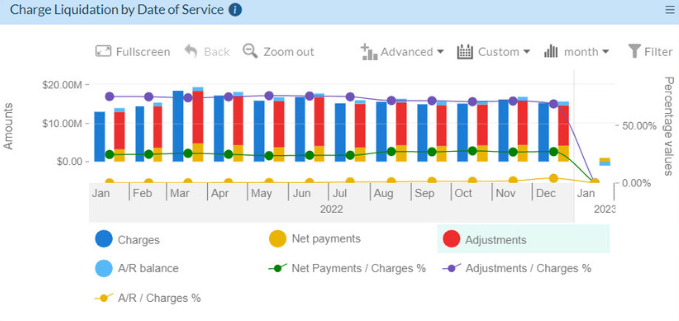

This metric allows you to break down financial data by the date of services rendered. You can track how much revenue has been generated and collected for specific service dates, helping you improve your collection rate.

The Work Relative Value Unit (RVU) measures the value of medical services based on the resources required. Tracking this KPI allows you to ensure that your organization is being compensated appropriately for the services it provides.

The payment lag measures the time it takes to receive payments after services have been provided. Monitoring this payment KPI helps you minimize delays in revenue collection, reducing your overall debt rate.

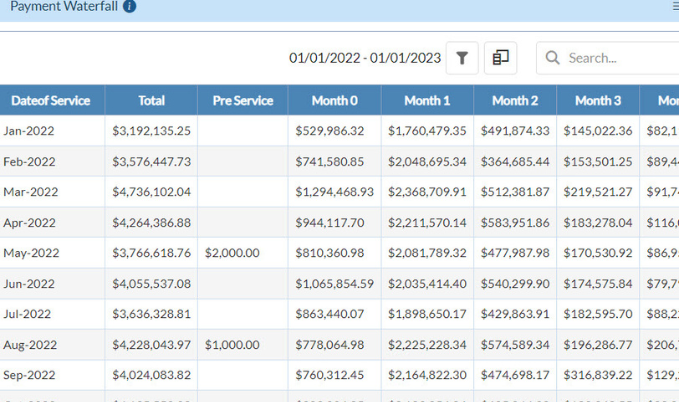

A payment waterfall analysis breaks down how payments are applied to different components of a bill, such as the patient’s responsibility, insurance payments, or adjustments. It helps you understand how payments are distributed and identify areas of revenue leakage.

This metric shows the total payments that have been received and processed. Monitoring this payment KPI helps you assess the success of your collection rate efforts.

This payment KPI evaluates how quickly charges are being liquidated or resolved after services are provided. A high debt rate may indicate inefficiencies in your collections process.

This KPI compares the gross payments received with the net payments (after deductions like adjustments and refunds). By tracking this metric, you can gain insights into your organization’s true financial performance and pinpoint potential revenue loss.

This metric provides a breakdown of how charges are liquidated based on the date of service (DOS) and the original financial class (FC). It is particularly useful for identifying revenue leakage in specific areas.

Track how charges, payments, and adjustments vary by the original financial class and date of service. This metric helps you understand where revenue loss is occurring.

This KPI tracks how charges, payments, and adjustments are applied based on the original financial class and the post date of the payment, helping you to optimize your KPI framework.

This predictive metric helps you forecast future revenue based on past payment KPIs. It’s a crucial tool for proactive financial planning.

This payment KPI tracks the performance of individual collectors within your organization, helping you identify who is excelling and who may need additional training to improve the collection rate.

This metric shows how much revenue your organization has earned based on the contracted rates with insurance companies, giving you an accurate picture of your true financial performance.

This KPI provides a detailed summary of financial transactions, allowing you to stay on top of debt rate and revenue leakage.

This metric tracks the performance of Evaluation and Management (E&M) services, giving you insights into how well these services are generating revenue.

Measuring payment KPIs in healthcare is essential for maintaining financial stability and operational efficiency. By using a structured KPI framework and tools like WhiteSpace Health’s AI analytics platform, you can reduce revenue leakage, improve your collection rate, and minimize your debt rate. A well-implemented KPI dashboard provides the clarity needed to address potential issues before they escalate into major financial losses.

Tracking and analyzing payment KPIs empower your organization to take control of its financial destiny, ensuring that it remains sustainable in the long run. Don’t let revenue loss and inefficiencies undermine your success—start measuring your payment KPIs today.

2424 North Federal Highway, Suite 205

Boca Raton, FL 33431