by Carrie Bauman

You already know that a healthy revenue cycle is essential for your healthcare organization’s sustainability. But today, a silent crisis is brewing in one of the most overlooked segments of your receivables patient accounts receivable (A/R). With high-deductible health plans, increased cost-sharing, and delayed payments, patient financial responsibility now directly impacts your bottom line.

If you are not tracking your patient accounts receivable metrics with precision and speed, you may be watching potential revenue slowly slip away. Understanding these KPIs and using the right tools to manage them can be the difference between steady cash flow and chronic revenue leakage.

Patient accounts receivable is the total amount your patients owe after insurance has processed the claim, or in some cases, when there is no insurance at all. This includes:

While payer A/R gets plenty of attention, patient accounts receivable have quietly grown. According to a 2023 report by the Kaiser Family Foundation, the average deductible for employer-sponsored insurance rose to over $1,700, more than double what it was a decade ago. Meanwhile, other studies have found that patient responsibility accounts for over 30% of provider revenue. However, providers only collect 55 to 70% of that. That means nearly 1 in 3 dollars billed to patients is either delayed or never collected. When you zoom out, this is not just an operational concern. It is a serious threat to your healthcare financial stability.

If your organization does not actively monitor patient accounts receivable KPIs, you risk:

Because patients are also consumers, their experience with your streamline billing processes can shape their loyalty and your revenue.

To improve patient collections and avoid financial surprises, here are six key metrics you should track daily or weekly:

The total outstanding balance due from patients.

Break A/R into age buckets: 0–30 days, 31–60, 61–90, 91–120, and over 120 using an accounts receivable aging report.

The higher this number, the harder it is to collect and the greater the risk of revenue leakage.

What percent of the patient-owed amount are you actually collecting?

The percentage of patient accounts receivable written off as uncollectible.

The percentage of payments collected from patients at or before the time of service.

These KPIs give you an accurate picture of how well your organization is engaging with patients financially and where the bottlenecks are in revenue cycle efficiency.

Patient accounts receivable is not just growing by accident. It is being driven by four major shifts in how Americans pay for care.

More than 50% of privately insured Americans are enrolled in HDHPs. With deductibles of $2,000 or more, patients are now responsible for a significant portion of the bill, especially early in the year.

Even insured patients are underinsured. Many defer care or struggle to pay their portion, especially for outpatient and diagnostic services.

According to a recent TransUnion Healthcare report, 65% of patients said they were surprised by a medical bill they received, and 48% delayed payment due to cost concerns, disrupting cash flow management.

Late billing, missing cost estimates, and unclear communication often result in patients ignoring their statements or giving up on payment altogether.

When you connect the dots, it is clear: managing patient accounts receivable is no longer just about collections. It is about systemic, proactive financial engagement and operational efficiency.

Modern technology now allows you to go far beyond manual spreadsheets and static reports. With AI-driven dashboards and smart workflows, you can:

Smart dashboards powered by AI allow you to monitor real-time patient accounts receivable balances. These dashboards color-code performance using red-yellow-green indicators. Red means urgent underperformance, yellow signals caution, and green shows areas that are doing well. This visual structure supports better cash flow oversight and prioritization.

With one click, you can filter balances by:

You can instantly find where spikes are occurring and take targeted action, such as addressing denied claims, updating front-desk protocols, or enhancing financial clearance.

AI can trigger claim follow-up actions such as:

These tools help eliminate revenue leakage and reduce bad debt through smarter workflows.

Graphical overlays allow you to compare this week’s performance to last month’s or last quarter’s. Whether identifying growth in patient accounts receivable or lagging collection rates, this empowers leaders to act and improve revenue cycle efficiency.

Here are 4 actions with immediate impact on patient accounts receivable:

Top-performing facilities collect up to 70% more at POS than average performers. Train and monitor staff performance for:

This boosts upfront cash flow and reduces bad debt exposure.

When patients have visibility and options, they pay faster. Offer:

Use scripts and tools to explain:

This reduces disputes and claim follow-up burdens while improving operational efficiency.

Pin patient accounts receivable metrics to your dashboard. Hold daily huddles to review:

This rhythm creates agility and financial visibility.

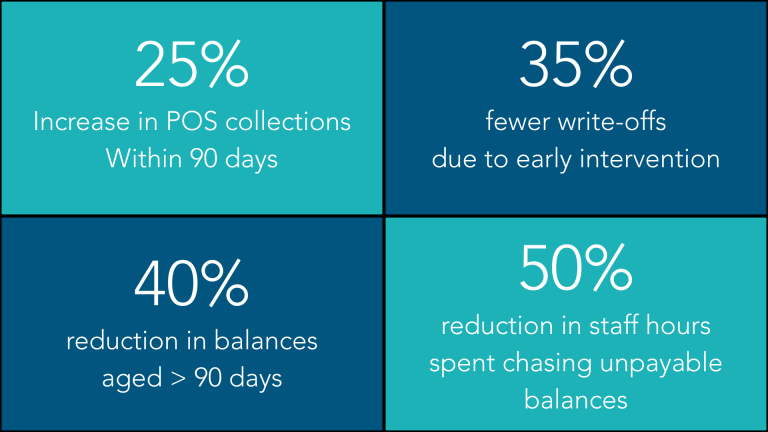

When you apply data-driven workflows to patient accounts receivable, the results are measurable:

Better A/R performance not only boosts cash flow, but also contributes to healthcare financial stability and sustainable streamline billing practices.

You are already dealing with high patient financial responsibility, overworked billing teams, and increasingly complex payer contracts. Ignoring patient accounts receivable only adds risk to your already thin margins. But by focusing on patient accounts receivable KPIs, you can:

Patient accounts receivable is no longer the back-end burden it used to be; it is a strategic frontier. When you monitor KPIs daily, use predictive analytics, and build proactive engagement models, you transform patient collections from a pain point into a competitive advantage, enhancing cash flow, reducing bad debt, and driving long-term healthcare financial stability.

A 30-year veteran of healthcare IT, Carrie Bauman is responsible for marketing, communications and business development strategies that drive brand awareness, growth and value for clients, partners and investors.

2424 North Federal Highway, Suite 205

Boca Raton, FL 33431