by Carrie Bauman

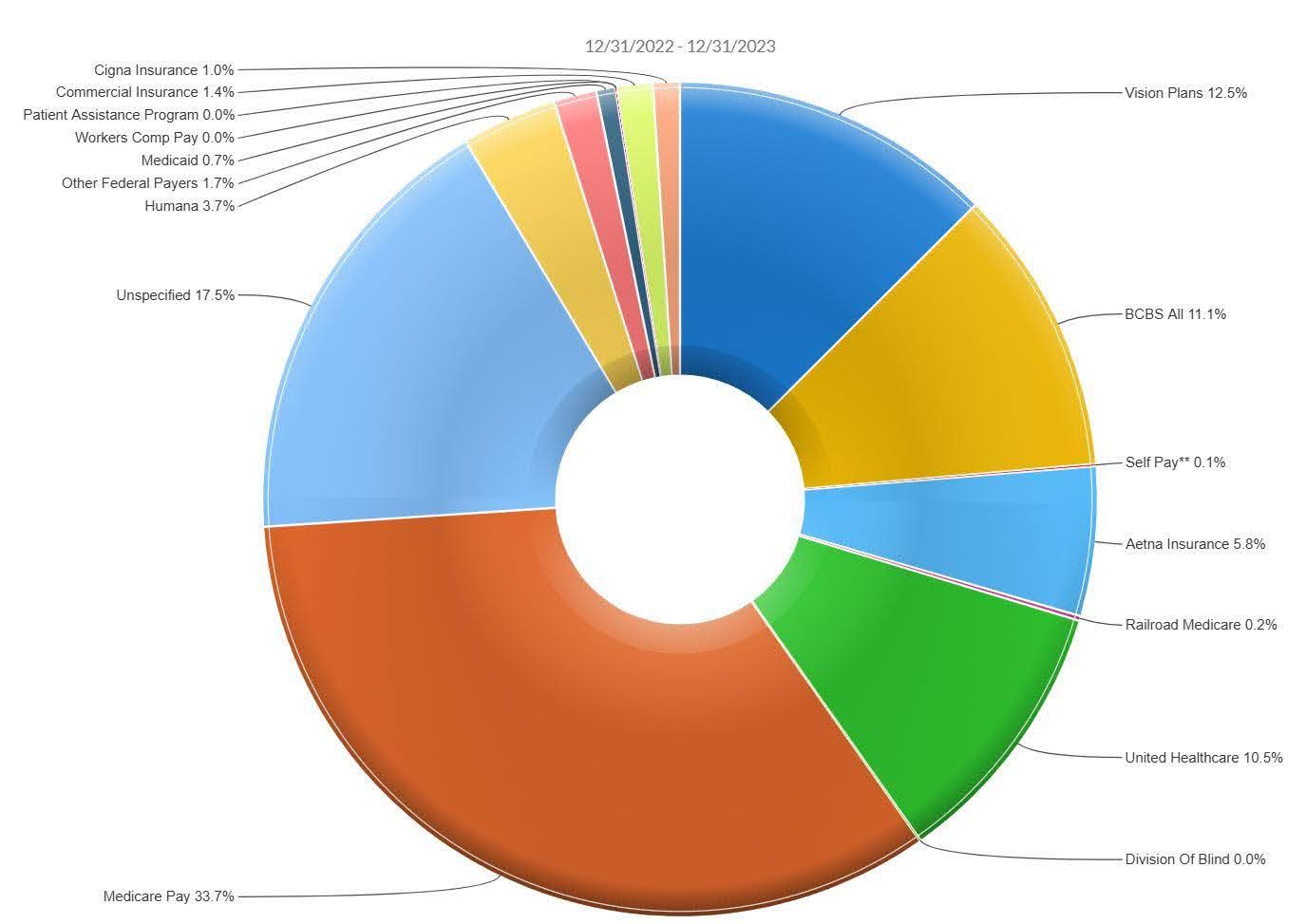

Payer mix intelligence is insight into which payers (Medicaid, Medicare, commercial, self-pay, or uninsured) are driving your ED volume and revenue daily. With dynamic patient flow and reimbursement shifts, your financial performance can vary drastically from one day to the next. This requires constant payer mix analysis.

According to a national study, your ED probably sees around 35% Medicaid, 26% Medicare/Medicare Advantage, and 39% commercial insurance. Even more concerning? At least 65% of ED visits are reimbursed below cost, due to high Medicaid, self-pay, and uninsured volumes. This highlights the importance of understanding your payer mix.

Without real-time clarity on which payers are arriving today, you may be flying blind:

All these questions are answered through robust payer mix intelligence.

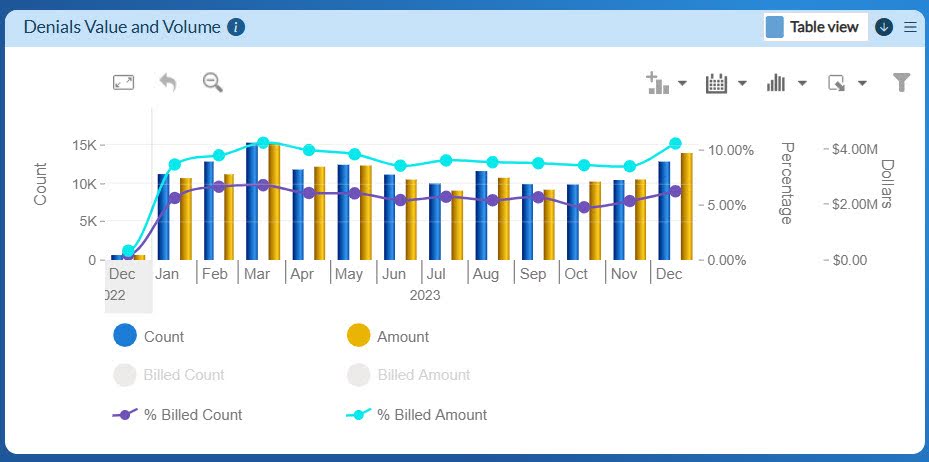

Your current systems may provide weekly or monthly snapshots, but that is often too late. By the time trends are visible, claims processing is already underway, denial rates are stacking up, and staff resources are misaligned.

Without real-time revenue cycle analytics and payer mix intelligence:

Imagine you wake up and see an alert: Today’s payer mix is 50% Medicaid, up from 35% yesterday, and commercial is down to 25%. With an automated platform and strong payer mix intelligence, you can:

By using this kind of AI-driven platform for payer mix intelligence, EDs have reported:

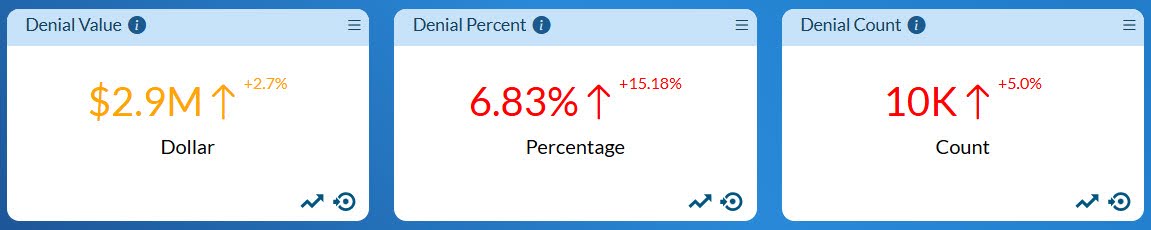

These trends confirm that you cannot rely on static projections, your payer mix is changing rapidly, and compensation is decreasing.

Whitepaper insights show that analytics help EDs:

Set up daily extraction from registration data and EHR to feed an AI analytics platform for payer mix intelligence.

Define thresholds (e.g., Medicaid share > 45%) to trigger proactive tasks, like verifying documentation or adjusting charge capture.

Feed alerts into billing denial teams. Focus efforts on claims impacted by today’s unusual payer mix.

Adjust nurse and provider schedules to reflect payer mix and acuity, maximize both care delivery and financial return.

Track metrics such as denial rates, capture rates, and collection rates; compare them to payer mix shifts. Review weekly and communicate trends with leadership.

As Medicare Advantage enrollment trends up, Medicaid redetermination reforms continue, and commercial payers pressure reimbursement rates, daily visibility is no longer optional; it is essential. The next wave of ED survival and growth depends on agile financial intelligence.

You cannot fix what you cannot see. When reimbursement is margin-thin, and payer composition changes by the hour, a daily AI-powered analytics solution helps you harness payer mix intelligence to:

Your ED is mission-critical, but it cannot operate without financial stability. This level of daily intelligence transforms revenue strategy from reactive to predictive. Your leadership depends on it.

A 30-year veteran of healthcare IT, Carrie Bauman is responsible for marketing, communications and business development strategies that drive brand awareness, growth and value for clients, partners and investors.

2424 North Federal Highway, Suite 205

Boca Raton, FL 33431